The Top 13 Project Selection Methods

Published:

Updated:

Becoming an effective project manager takes a variety of skills. It requires strong leadership, superior communication abilities, meticulous planning, and a number of other essential characteristics as well. But there's one skill that doesn't get enough emphasis in the world of project management - strategic and effectual project selection.

In fact, a recent Six Sigma-focused study of 43 different companies found that an astounding 75% didn't even follow the project selection methods.

"Ultimately," writes Six Sigma Qualtec, "if you don't have a project selection process in place - one that is rigorously followed - you will falter."

An informed and experienced approach to project selection allows your company to more effectively manage prospective projects, identify key efforts with more substantial ROIs, and leverage the skills already in place to select projects well-suited for your company's particular competencies.

In most cases, the final decision on which proposals are accepted generally will fall to executive leadership rather than project managers (PMs). However, a good project manager should be able to use their experience to help guide decision-makers toward choosing an ideal project while still keeping risk and cost estimates realistic.

The Importance of Project Selection Methods

Before examining the two main methods of project selection as well as their various techniques, it's important to understand just why project selection is important for your business.

In addition to using the right project management methodology for your company, selecting the right projects can mean the difference between one year in the black or several in the red. An unreasonable project scope, loosely defined deliverables, and unrealistic goals can all lead to an enormous drain on your budget and critically damage productivity as well.

Picking the right projects isn't as easy as just trusting your gut. Instead, selecting the right project for your company's skills and available resources requires a bit of a pretty important calculation on your part. These calculations can be done in two different ways: using the Benefit Measurement Methods or the Constrained Optimization Methods.

Table of Contents

Method #1: Benefit Measurement Methods

The Benefit Measurement Methods are likely going to be the only methods you'll be using directly as a project manager. While less complex than the Constrained Optimization Methods, they often don't require an advanced degree in finance to understand them.

They are great for smaller projects that aren't especially complicated. Benefit Measurement Methods, as the name suggests, rate potential projects according to a specific model and compare those results between the project candidates. Below are the most common Benefit Measurement Methods you'll be using as a PM.

1. Cost-Benefit Ratio

The simplest of the Benefit Measurement Methods, the cost-benefit ratio is an effective way of communicating the potential value of a project in easily understandable terms. It measures the costs of investing in a project against the value of the return once it is completed.

A project that requires $280,000 in resources to complete with an expected $420,000 return would have a 4:6 (or 2:3) cost-benefit ratio. Essentially, every $2 invested in this project would yield $3 in revenue. Projects with a lower cost-benefit ratio (or a higher benefit-cost ratio) should be selected if evaluated only by this method.

2. Economic Model

The Economic Model, also known as the Economic Value Added (EVA), is similar to the Cost Benefit Ratio technique in that it describes the difference between costs invested and revenue generated in one number - profit.

Investopedia aptly defines EVA as net operating profit after tax - (invested capital X weighted average cost of capital). This model provides a clear representation of the quantifiable benefits of a project once it's completed and can help give you a solid idea of what kinds of returns to expect for each project.

3. Payback Period

The Payback Period Technique takes a look at how long it will take your company to recoup its expenses with a particular project. If our $280,000 project were to bring in $20,000 a year once it's completed, the total payback period would be 14 years.

It's worth remembering though, that any time you try to factor in returns over time you should be looking at the present dollar value of the future revenue as inflation and interest will all come into play.

4. Discounted Cash Flow (DCF)

The Discounted Cash Flow Analysis handles the problem of calculating the present value of future earned dollars. This is one of the best ways to calculate value of returns that occur over a long period of time rather than immediately after completion.

While the Payback Period Model is easy to calculate and simple to understand, the Discounted Cash Flow (DCF) model incorporates the time value of money. This concept helps translate future earnings into present day dollar values since a dollar in hand has more earning potential than one promised for later.

5. Net Present Value (NPV)

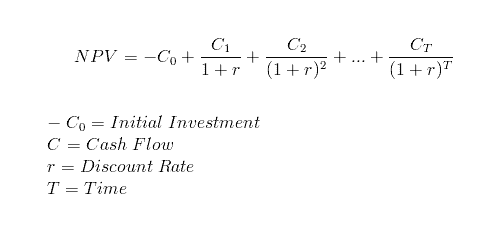

Using Discounted Cash Flow, the Net Present Value (NPV) model helps put the whole lifecycle of the project into perspective in terms of earnings.

For instance, calculating the earnings for year one of the project may return a net loss of, say, $800. Year two may see a loss of $200, while years three, four, and five may result in gains of $500, $1000, and $1500. All of these values would of course be informed by the DCF concept to translate future values into present dollars.

The Net Present Value of the project, then, would be the combination of all of these numbers ($3000 minus losses of $1000) and would equal $2000.

While there are a number of essential free tools at a project manager's disposal in general, the easiest one for calculating NPV is Excel by far.

For help in determining how to calculate NPV using Excel, head over to Microsoft's help page dedicated to the subject.

The equation for determining Net Present Value according to Finance Formulas is:

6. Scoring Models

Scoring Models may be the most flexible way of comparing projects to one another. Rather than focusing purely on financials, Scoring Models let you determine which qualities of a project are most important to you, your team, and your company at large.

You may, for example, choose to look at profitability, overall risk, support from stakeholders, and the difficulty of the project.

Once the criteria are chosen, you'll want to weigh them according to your priorities and rank each project in terms of these four measures using a consistent scale. The total numbers for a single project are then combined and used to reflect the project's total value, making it easy to compare your projects to one another.

7. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) incorporates the Net Present Value into its calculation by setting the NPV to zero. Essentially, this means that all cash flow from a project (both negative and positive) even each other out.

Using the same equation as NPV where the NPV is set to zero, the IRR of a project is determined by solving for the variable "r" rather than NPV. If the Internal Rate of Return for a project is lower than the company's required rate of return (RRR), then that project can be eliminated entirely.

8. Opportunity Cost

The concept of opportunity cost is crucial to understand for any certified project manager worth their salt. Essentially, Opportunity Cost comes down to what you're missing out on by choosing one project over another.

More a supplemental technique than a standalone method itself, Opportunity Cost can be a great way to put a certain project choice into perspective. If, for example, Project 1 and Project 2 are worth $75,000 and $85,000 respectively, going with Project 1 would have an opportunity cost of $10,000 since that's how much your company would miss out on.

Method #2: Constrained Optimization Methods

While the Benefit Measurement Methods are generally the most widely used Project Selection methods for project managers, Constrained Optimization Methods may also come into play. These methods are great for larger, more complex projects where a number of intricate mathematical calculations will need to be performed.

In fact, the Constrained Optimization Methods are also known as the Mathematical Model of Project Selection.

Given their complexity though, many project managers will likely choose the Benefit Measurement methods to meet their Project Selection needs. What's more, the Constrained Optimization Methods are not covered in-depth in the PMP certification exam but are provided here for supplementary purposes only.

For more information on the methods below, Testing Brain provides quite a comprehensive look at each.

1. Linear Programming

This programming method involves bringing down the cost of the project through a reduction of the time required to complete it.

2. Non-linear Programming

Nonlinear Programming aims at solving optimization problems within projects wherein some of the constraints or functions are nonlinear.

3. Integer Programming

This method focuses on integer values rather than fractional ones. Some products, like tables for example, can never be fractional.

4. Dynamic Programming

This method involves simplifying a complex problem by separating it into a number of simpler problems.

5. Multiple Objective Programming

The Multiple Objective Programming approach focuses on making a decision for a number of problems using mathematical optimization.

As a project manager, you'll undoubtedly have the opportunity to influence key decision-makers when it comes to project selection. Your expertise, institutional knowledge, and skills in the field can in fact be instrumental in ensuring your company picks out only the most promising of projects.

And with the variety of project selection methods and tools to choose from, you can be sure you've made the right choice each time. You can learn more about project selection methods in PMP certification training courses.