How to Learn and Memorize the PMP Calculation Formulas? 30 Formulas (& Examples) to Know for PMP Exam 2024

Published:

Updated:

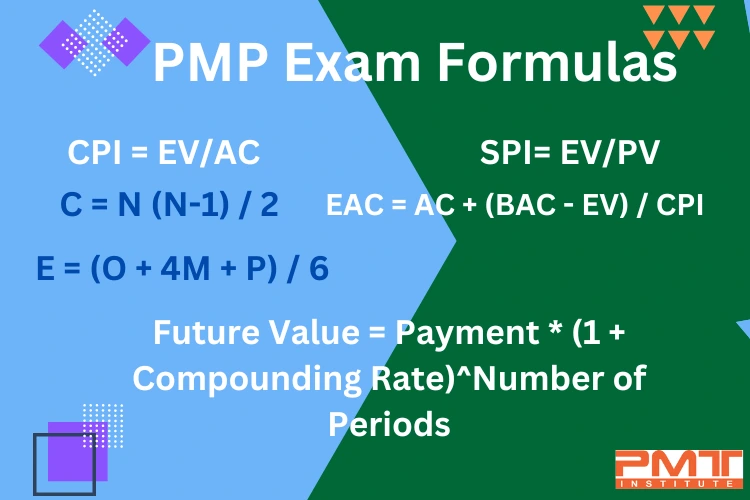

Whether you are working as a project manager or studying to pass the project management exam, it is essential to have a strong understanding of key PMI formulas and calculations. These formulas can help predict the project timelines and budgets and keep track of the project's progress. In this resource, Project Management Training Institute will tell you some formulas and calculations commonly used in project management. Following is a list of some PMI Formulas and Calculations, critical for understanding different aspects of a project.

Earned Value

One of PMP's most commonly used formulas is the Earned value (EV). It is the way of determining the progress of a project. Through Earned Value, the project managers can evaluate if the project is going to complete within the budget or not. In order to calculate Earned Value, you need to multiply the percentage of work completed by the budget at Completion (BAC).

If you want to calculate the earned value, you have to use the following formula.

EV = % of work completed * BAC

Suppose you're working on a project that has a Budget at Completion of $200,000. Around 30% of the work has been completed. To calculate the earned value, multiply 30% of work completed with BAC, which is $200,000 in this case. The EV of the project will be:

EV = 30% * $200,000 = $60,000

Communication Channels

The project managers use different communication channels to inform the team members about the project's progress. These channels help them communicate any changes to the plan to the team members.

To calculate the number of channels that can be used for communicating the details about the project's progress, then the formula for determining the communication channels would be:

C = N (N-1) / 2

In this formula, N is equal to the number of team members. To calculate the communication channels, you have to multiply N with (N-1), which is the total number of members in the team minus one, then divides it by 2.

Take an example of a project with a total of 10 team members. The communication channels that can be used in the project would be:

C = 10 (10-1) / 2 = 45

According to this calculation, the number of communication channels in the project is 45, which includes one-on-one conversations, group meetings, and email exchanges.

Cost Variance

You can define cost variance (CV) as finding the extent to which a project is over or under budget. The CV is calculated by subtracting the actual cost (AC) from the earned value (EV). The formula for cost variance is as follows.

CV = EV - AC

Suppose you're working on a project which has an earned value of $70,000, and the actual cost of the work completed is $55,000. The cost variance of the project would be:

CV = $70,000 - $55,000 = $15,000

If the cost variance is positive, it shows the project is under budget, whereas a negative CV indicates the project is over budget.

Schedule Variance

Like cost variance, schedule variance is used to determine the extent to which a project is ahead or behind schedule. To find whether the project is ahead or behind schedule, you need to subtract the planned value (PV) from the project's earned value (EV). The formula for calculating the schedule variance is as follows.

SV = EV - PV

Take an example of a project which has an earned value of $60,000 and the planned value of $50,000. The schedule variance would be:

SV = $60,000 - $50,000 = $10,000

In this example, the project is ahead of schedule as the schedule variance is positive. On the other hand, a negative SV would indicate that the project is behind schedule.

Cost Performance Index

CPI, or Cost Performance Index, is defined as the measure of calculating the efficiency of the project. It is the way of finding whether the project is under or over the budget. In order to calculate it, you have to divide the earned value (EV) of the project by the actual cost (AC) of the work that has been completed. The formula of CPI is:

CPI = EV / AC

Suppose you're working on a project which has an earned value of $60,000, and the actual cost of the work completed is $45,000. The CPI of the project would be:

CPI = $50,000 / $45,000 = 1.33

As CPI is greater than 1, it indicates the project is under budget. If a CPI is less than 1, it indicates that the project is over budget.

Schedule Performance Index

Another PMP formula that is used quite frequently by project managers is the Schedule Performance Index (SPI) which is a measure of finding the efficiency of the project schedule. This is calculated by dividing the project's earned value (EV) by the planned value (PV) of the project that must be completed at a specific time. In order to calculate SPI, you have to use the following formula.

SPI = EV / PV

Suppose you're working on a project with an earned value of $70,000, and the planned value of the work completed is $55,000. The SPI of the project would be:

SPI = $70,000 / $55,000 = 1.27

The result shows that the project is ahead of schedule as the project has an SPI greater than 1, whereas an SPI of less than one would indicate that the project is behind schedule.

Estimate at Completion

EAC, or Estimate at Completion, is a PMI formula that project managers use to calculate the total project cost at Completion. It is an estimate and can be calculated by adding the actual cost (AC) of the work that has been completed to the difference between the budget at Completion (BAC) and the earned value (EV) of the project. After that, it is divided by the cost performance index (CPI). For your convenience, we have shared the formula of EAC.

EAC = AC + (BAC - EV) / CPI

Take an example of a project which has a budget at Completion of $200,000, an earned value of $60,000, an actual cost of $50,000, and a CPI of 2.00. In this case, the Estimate at the Completion of the project would be:

EAC = $50,000 + ($200,000 - $60,000) / 2.00 = $95,000

Variance at Completion

The difference between budget at Completion and Estimate at Completion is called Variance at Completion. The formula to calculate VAC is as follows.

VAC = BAC - EAC

Let's say you're working on a project which has a budget at Completion of $200,000 and an estimate at the Completion of $105,000, the Variance at Completion would be:

VAC = $200,000 - $105,000 = $95,000

The result shows that the project is under budget as VAC is positive. If the VAC is negative, the project will be over budget.

Estimate to Complete

Sometimes a project needs additional costs for its Completion, which is why project managers need to assess the remaining cost of the project.

In order to estimate the additional cost that will be incurred to complete a project, the project manager uses the Estimate to Complete (ETC) formula. ETC is calculated by subtracting the actual cost (AC) of the work that has been completed from the project's budget at Completion (BAC). The formula for calculating ETC is as follows.

ETC = BAC - AC

To illustrate how the ETC of any project is calculated, we will use the example of a project that has a budget at Completion of $90,000 and an actual cost of $75,000. The Estimate for Completion of the project would be:

ETC = $90,000 - $75,000 = $15,000

To Complete Performance Index (TCPI)

Another PMI formula that is used quite often is TCPI or the To Complete Performance Index. It determines the efficiency required to complete the project within the budget. The formula for calculating TCPI is as follows.

TCPI = BAC / ETC

BAC = Budget at Completion

ETC = Estimate at Completion

For instance, if a project has a budget at Completion of $80,000 and an Estimate to Completion of $65,000, the TCPI would be:

TCPI = $80,000 / $65,000 = 1.23

This shows that the project is on track to be completed under budget as TCPI exceeds 1. On the other hand, a TCPI of 1 indicates that the project will be completed within the budget, whereas a TCPI of less than 1 indicates that the project will be over budget.

Total Float

Total Float is another important metric for project managers as it helps them to measure the flexibility of the project and identify any potential issues that can affect the project schedule. In order to calculate Total Float, you have to subtract the early start (ES) and early finish (EF) of the activity from the late start (LS) and late finish (LF) of the activity. The formula for TF is as follows.

TF = LS - ES = LF - EF

For example, if an activity has an early start of Day 1, an early finish of Day 4, a late start of Day 3, and a late finish of Day 6, the total Float of the project will be:

TF = Day 3 - Day 1 = Day 6 - Day 4 = 2 days

PERT Formula

PERT, or Program Evaluation Review Technique, is a project management tool that can be used to figure out and represent the tasks involved in completing a project. It can help identify the dependencies between tasks, estimate each task's duration, and determine the project's critical path. All these things are integral for the Completion of a project.

This formula is used to calculate the expected duration of a task based on the optimistic, most likely, and pessimistic estimates of the task duration.

The formula of the Program Evaluation Review Technique is as follows:

E = (O + 4M + P) / 6

In this formula, E represents the expected duration of the task, O represents an optimistic estimate of the task duration, M represents the most likely Estimate of the task duration, and P represents a pessimistic estimate of the task duration.

Assume that a task in the project has an optimistic estimate of a task duration of 2 days, the most likely Estimate of 4 days, and the pessimistic Estimate of 6 days. In this case, the expected duration of the task will be:

E = (2 + 4 + 6) / 6 = 4 days

Risk Priority Number

RPN or Risk priority number (RPN) is another important risk management metric that project managers use to prioritize risks based on their likelihood of occurrence and potential impact on the project. This RPN is calculated by multiplying the likelihood of occurrence (O) of risk with its potential impact (I) on the project. The formula of the Risk Priority Number would be as follows.

RPN = O x I

The likelihood of occurrence and potential impact of risk is rated on a scale of 1 to 10. Take a simple example of a project where the risk has a likelihood of occurrence of 6 and a potential impact of 7. The RPN would be:

RPN = 6 x 7 = 42

The result shows that risk has a higher RPN which shows that this risk in the project should be prioritized and addressed as soon as possible. After finding the risk with higher priority, the project managers can shift their focus towards the most critical risks and take appropriate measures to manage them.

Benefit-Cost Ratio

The benefit-cost ratio (BCR) compares a project's total benefits to its total costs. This formula is essential for determining the economic feasibility of the project. In order to calculate BCR, you need to use the following formula.

BCR = Total Benefits / Total Costs

In this formula, the total benefit is referred to as the sum of all the positive outcomes or impacts of a project or program. These may include financial benefits, such as increased revenues or cost savings, and non-financial benefits, such as improved environmental or social outcomes.

The total cost in the formula represents the sum of all the resources required to complete a project. It may include direct and indirect costs such as materials, labor, overhead, and financing costs.

For example, if you're working on a project and want to find out whether an investment is good or bad for the project, you can use the BCR formula. If the result shows a BCR of greater than 1, it indicates that the project's benefits outweigh the costs, making it a good investment. If the result is less than 1, it indicates that the project's costs outweigh the benefits, making it a poor investment.

Mostly, organizations use BCR to decide which projects to invest in as it can help them find the investment that is likely to provide a better return on investment. The organization uses it for both single and portfolio of projects. It is pertinent to mention that the BCR is only one factor. It would be best to consider other factors as well, like the risk profile of the project and the potential for non-monetary benefits, when evaluating the feasibility of a project.

Payback Period

The payback period is a financial term used to measure the time it will take for an investment to generate cash flow that is enough to recover its initial cost. In order to calculate the payback period, you have to divide the initial cost of an investment by the annual cash flow generated by the investment.

Assume you are making an investment of $1000 that will generate $200 in cash flow each year. The payback period would be (1000 / 200 = 5 years).

It is a useful tool for finding the short-term feasibility of the investment. However, the drawback of using this financial metric is that it needs to consider some factors like risks involved in the investment. This is why it is used in conjunction with other financial metrics, like return on investment (ROI) or net present value (NPV), to make more informed investment decisions.

Cost Plus Fixed Fee (CPFF)

A pricing structure known as cost plus fixed fee (CPFF) is used in contracts where a buyer agrees to pay a contractor the project's direct costs in addition to a predetermined charge. The set fee is often a pre-decided sum used to cover the contractor's profit and costs. It is agreed upon by both the buyer and the contractor.

Imagine that a purchaser contracts a builder to construct a brand-new office structure. The contractor calculates that the project will cost $500,000 in direct costs, including labor and supplies. To cover the contractor's expenses and profit, the buyer and the contractor agree on a fixed fee of $100,000.

The project would cost $600,000 overall under a CPFF contract ($500,000 in direct expenditures plus $100,000 in fixed fees). The contractor would be in charge of overseeing the project and making sure that it is finished within the spending limit and time frame. The contractor would also be accountable for maintaining precise records of all project-related expenses and submitting those expenses to the customer for payment.

Cost Plus Incentive Fee (CPIF)

In this pricing structure, a buyer agrees to pay a contractor the direct expenses of a project plus an incentive fee based on the contractor's performance. The incentive fee compensates the contractor for achieving the set performance benchmarks.

The buyer usually sets the incentive fee based on a portion of the project's direct costs.

Return on Investment (ROI)

One of the popular metrics used in project management is ROI or Return on investment. Project managers use this financial metric to calculate the profitability of an investment. This ROI is calculated by dividing the net profit of an investment by the initial cost of the investment. In order to calculate ROI, you need to use the following formula.

Return on Investment = (Net Profit / Initial Cost) x 100

In this formula, the net profit is referred to as the total income from the investment minus any associated costs or expenses. Simply put, it is the total amount left after you have made all the payments.

The initial cost is referred to as the total amount you have invested at the start of the project. To help you understand the calculation, we have shared an example of a simple investment.

Let's say you have invested $10,000 in a stock that pays a dividend of $500 each year. However, you decide to sell the stock after one year for $11,000. In this case, the net profit is $1000, and the initial cost is $10,000. The ROI of the investment will be:

ROI = (1,000 / 10,000) x 100 = 10%

The current value of a future cash flow or series of payments is referred to as its present value in finance. It is used to calculate the current worth of an investment. In order to calculate the future cash flow's present value, you have to take the discount rate into consideration. The smaller the current value of the cash flow, the higher the discount rate will be. Following is the formula for calculating the present value of future cash flow.

Present Value

One of the popular metrics used in project management is ROI or Return on investment. Project managers use this financial metric to calculate the profitability of an investment. This ROI is calculated by dividing the net profit of an investment by the initial cost of the investment. In order to calculate ROI, you need to use the following formula.

Present Value = Future Cash Flow / (1 + Discount Rate)^Number of Periods

In this formula, the future cash flow is the amount of money that is expected to be received in the future. In contrast, the discount rate is the rate of return used to account for the time value of money. This discount rate is typically represented in a percentage. The number of periods is the period over which the cash flow is expected to be received. Suppose the cash flow is expected to be received over five years. The number of periods would be 5.

Point of Total Assumption

A financial concept known as the point of total assumption (PTA) is used for identifying the time when an entity assumes full financial obligation for a project. It is the point at which the project's investment by the organization matches the project's completion cost. This PTA is calculated by adding the cost incurred so far with the expected costs to complete the project. After adding both, you have to divide the result by the project's overall value.

To calculate the point of total assumption, you have to use the formula below.

PTA = (Costs Incurred + Estimated Costs to Complete) / Total Value of Project

In this formula, the costs incurred are the cost that has been incurred to date on the project. This may include all the direct and indirect costs incurred so far in the project. The estimated cost to complete is referred to as the cost which is required for the Completion of the project. It may include costs for materials, labor, and other resources needed to complete the project.

Finally, the project's total value is the sum of all the costs and revenues.

Future value

You will come across this financial concept when working as a project manager. It is referred to as the value of an asset at a future time. This financial metric is used to measure an investment's potential value at a given point in the future. To calculate the future value of an asset, you have to use the following formula.

Future Value = Payment * (1 + Compounding Rate)^Number of Periods

In this Future Value formula, the payment is the amount of money being invested or received. This can be a single payment or a series of payments over a specified period. The compounding rate is the rate of return used to account for the time value of money.

Standard Deviation

Another statistical measure used quite commonly in project management is Standard deviation. This is a measure of the degree to which the individual values in a dataset differ from the mean of the dataset.

The formula for calculating standard deviation is:

Standard Deviation = √(S(X - Mean)^2 / N)

Where:

X is an individual value in the dataset

Mean is the mean of the dataset

S represents the sum of all values in the dataset

N expresses the number of values in the dataset

It would be best if you first determine the mean of the dataset in order to calculate the standard deviation. This can be accomplished by adding up all of the dataset's values and dividing by the total number of values.

The mean must then be subtracted from each item in the dataset before you square the result. The next step is to add up all of the squared values and divide by the total number of values. In order to determine the standard deviation, you will finally take the square root of this value.

Understanding a dataset's distribution and spotting patterns or trends may both be done with the help of the standard deviation. When assessing an investment's risk, this statistical measure is used.

It's worth noting that standard deviation is sensitive to outliers, or extreme values, in a dataset. As a result, it may only sometimes provide a reliable measure of dispersion for datasets with many outliers. In such cases, other measures of dispersion, such as the interquartile range or the median absolute deviation, may be more appropriate.

Net Present Value (NPV)

Another important metric that is used for determining the profitability of an investment or a project is the Net Present Value (NPV). This NPV is calculated by discounting the expected cash flows of the investment or project at a specified discount rate and comparing the result to the initial cost of the investment.

If the present value of the expected cash flow exceeds the initial cost of the investment, the NPV would be positive. In contrast, the NPV is negative when the present value of the expected cash flow is less than the initial cost.

The formula for calculating NPV is as follows.

NPV = Σ(Expected Cash Flow / (1 + Discount Rate)^Period) - Initial Cost

In this formula, Σ represents the sum of all expected cash flows, and the expected cash flow is the amount of money that is expected to be received in each period. The discount rate in the formula is referred to as the rate of return that is used to account for the time value of money. The period in the formula is the time period over which the cash flow is expected to be received, and the initial cost is the amount of money that is invested in the project.

Expected Monetary Value

In project management, you will come across another important formula that is used to manage different aspects of the project. The formula which is used to evaluate potential risks and make informed decisions is called Expected Monetary Value (EMV). By using this formula, the project managers can identify and analyze the potential risks that can have an impact on the project. With the help of EMV analysis, the project managers can determine the best course of action for the project.

The formula for calculating the EMV is as follows.

EMV = probability of outcome * the potential impact of outcome

In the formula, the probability of the outcome is expressed as a decimal between 0 and 1, and the potential impact is the monetary value of the outcome that can be either positive or negative.

For instance, a project with a potential risk could take the cost above the budget. The cost overrun of the project is around $50,000, and the probability of this risk occurring is 30%. The EMV of the risk would be calculated as follows.

EMV = 0.30 * $50,000 = $15,000

This indicates that the expected value of the risk is a cost of $15,000.

This EMV analysis can be used to evaluate a wide range of potential risks and outcomes, including financial, schedule, and performance risks. With the help of EMV analysis, project managers can prioritize risk management activities and allocate resources accordingly to manage the project in a better way.

Summary

To sum it up, PMI formulas are useful for assessing any project's progress and potential success. With the help of formulas like EMV, NPV, BCR, etc., the project managers can identify any deviations from the original plan and take measures to ensure the project stays on track. This is why project managers should have a basic understanding of using these formulas to calculate different aspects of the project.